Login to Florida Retirement System Account:

You have eight schedule a very long time after your period of recruit to make a functioning political race between the Investment Plan and FRS Pension Plan. In the event that you don’t make a functioning political race before the finish of the political race time frame, there will be a default participation. You will make someone-memories second political race to change participation plans during your career.

You get a set, month to month advantage dependent on your age at retirement, pay, position, and how long you worked for the FRS. You get the parity of your speculation account; in view of how well the arrangement performed. When you resign, in the event that you are vested and are inside 20 years of your ordinary retirement age.

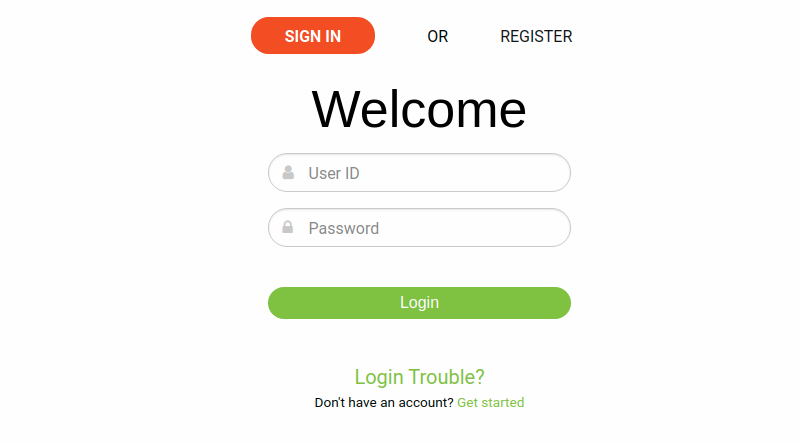

Florida Retirement System Login:

To login open the page, www.myfrs.com/sign-in.htm

- As the page opens at the center enter the login info, and click on, ‘Login’ button.

- If you are facing login issues, tap on, ‘Login trouble?’ button. In the next screen, you will have to follow the prompts.

- If you don’t have a PIN, you can request a PIN, and enter, SSN, last name, date of birth.

- To recover password, click on, ‘Forgotten password’ button. Provide the account email to proceed.

- To create an account, tap on, ‘Get started’ button. Enter your SSN, PIN, date of birth, and tap on, ‘Submit’ button.

Frequently asked questions on the Florida Retirement System:

- How the information can be received?

Endless supply of your arrangement decision political race, an affirmation of your decision will be sent to you at your personal residence as detailed by your manager inside 5-7 business days. On the off chance that you have moved if it’s not too much trouble update your location with your nearby workforce office as quickly as time permits.

- As a recently recruited worker, I have a cutoff time to choose which intend to take part in. Until I settle on a choice, am I took a crack at the retirement framework?

Starting on your first day of work, you are naturally joined up with the FRS Pension Plan and start to gather benefits under that arrangement. In the event that you choose for join the Investment Plan before your enlistment cutoff time, the entirety of the retirement commitments paid for your sake by your boss into the Pension Plan Trust Fund will be moved to your Investment Plan record to turn into your initial record balance.

- How does this decision influence the vesting of my retirement plan advantage?

On the off chance that you remain in the Pension Plan, you are dependent upon a 8-year vesting prerequisite. On the off chance that you move to the Investment Plan, your Pension Plan advantage will be vested after 8 years. You will be vested following 1 year of absolute help for all future business commitments in your Investment Plan account. You are in every case completely vested in your own commitments, as long as you remain tried out the arrangement you at first choose. How your worker commitments are disseminated or discounted to you relies upon various components, particularly on the off chance that you utilize your second Election to switch plans.

- In the event that I am in the Investment Plan or Investment Plan half and half choice and utilize my subsequent option chance to repurchase into the Pension Plan, would i be able to partake in the DROP?

Indeed, in the event that you are as yet qualified dependent on the qualification standards for DROP support.

- In what capacity would it be a good idea for me to consider DROP support when settling on the Pension Plan and the Investment Plan?

DROP permits you to at the same time gain a pay and retirement salary under the Pension Plan. That implies you can amass an expense conceded “savings.” If you hope to resign from a FRS business, that might be a huge factor. Note that Investment Plan individuals are not qualified for DROP. To enable you to choose, the CHOICE SERVICE will give internet displaying so you can research the effect of DROP support on your advantages under the two plans. Or then again, you can demand a gauge from the Division of Retirement.

Contact details:

To get more details to call on, 1-866-446-9377 (Toll-free).

Reference link: