US Bank Credit Card Application with Promotion Code :

US Bank is a bank holding company, based in America. They mainly focus on the customer and their needs. US Bank offers fully integrated wealth management services. US Bank provides investment, trusts, and estates administration banking to its consumers.

US Bank provides the US Bank Card offer promotion to their customers. You might receive special offers and information about credit cards. For this, your minimum age requirements are 18 years and you have to be a legal resident of the United States.

How to Apply for US Bank Credit Card with Promotion Code :

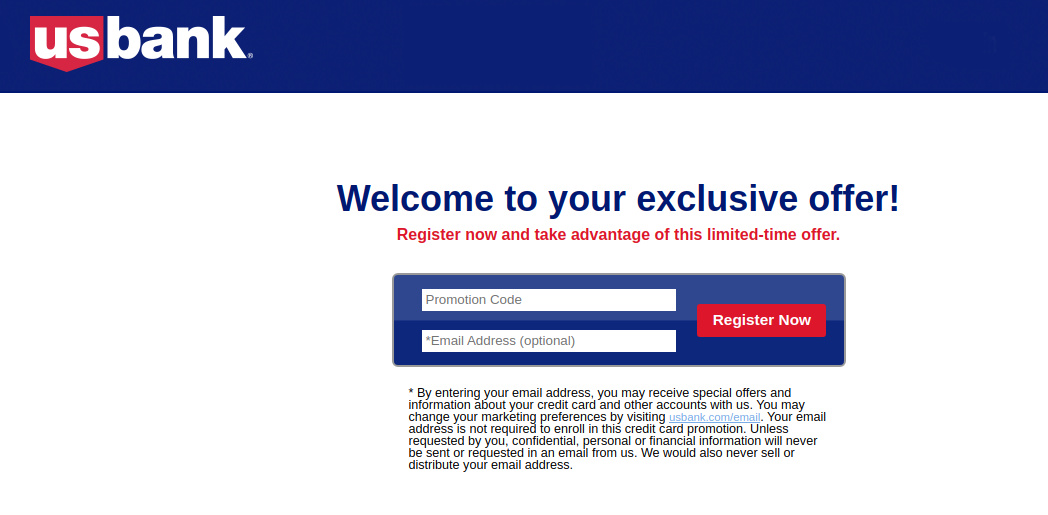

If you have received the promotional code for the US Bank credit card, then you can follow these simple steps below:

- You have to click on this link www.usbankcardoffers.com.

- Then, on the required fields, you have to provide your promotion code and email address.

- After that, you need to click on the Enroll Now option to proceed further.

You are preapproved for a credit card so you enter the above info you will receive US Bank credit card recommendations which you qualify for. You have to make your card selection and continue with the online credit card application.

How to Apply for US Bank Credit Card in Manual :

If you don’t have received any promotional code, then you can apply for the US Bank Credit Card manually. You can easily complete the application process by following these simple steps below:

- You need to click on this link www.usbank.com/credit-cards.

- Then, select the card, which you want to apply for.

- Then, there you just need to click on the Apply Now option.

- After that, provide all the required information to complete the application process.

Some of the Best Credit Cards Offered by US Bank :

US Bank offers a wide range of credit cards to their customers. These are some of the best credit cards offered by US Bank:

US Bank Cash Plus Visa Signature Card:

Benefits:

- You will get up to 5% cashback on your first $2,000 in combined eligible net purchases.

- After purchasing $500, you will get a $150 bonus within the first 90 days of account opening.

- On all the other eligible purchases, you will get 1% cashback.

Interest Rates and Fees:

Rates:

- APR for Purchase: The purchase APR of this card is 13.99% to 23.99%.

- APR for Balance Transfer: There will be no balance transfer for the first 12 billing cycles within the first 60 days. After that, the APR for the balance transfer will be 13.99% to 23.99%.

- APR for Cash Advances: The cash advance APR of this card is 23.99%.

Fees:

- Annual Fee: You would not have to pay any annual fees on this card.

- Balance Transfer Fee: For each balance transfer, you have to pay $5 or a minimum of 3% of the transferred amount.

- Cash Advance Fee: For the cash advance fee, you will be charged $10 or a minimum of 4% of the amount.

- Late Payment Fee: If you cannot make the credit card bill payment by the due date, you will be charged up to $40.

US Bank Visa Platinum Card:

Benefits:

- This card comes with a low intro APR for the first 20 billing cycles.

Interest Rates and Fees:

Rates:

- APR for Purchase: 0% intro APR on purchase for the first 20 billing cycles. After that, your APR for purchase, will be 13.99% to 23.99%.

- APR for Balance Transfer: There will be a 0% balance transfer APR for the first 20 billing cycles. The balance transfer will be 13.99% to 23.99%.

Fees:

- Annual Fee: There will be an annual fee on this US Bank credit card.

- Balance Transfer Fee: 3% of each balance transfer or a minimum of %5 will be charged.

- Cash Advance Fee: For every cash advance, you will be charged 4% of the amount of a minimum of $10.

- Late Payment Fee: If you cannot make the payment for credit card bill by the due date, you will be charged up to $40.

US Bank FlexPerks Gold American Express Card:

Benefits:

- You will get 30,000 bonus FlexPoints on your eligible purchases within the first four months.

- You will receive 3X FlexPoints in purchases at restaurants.

- Earn 2X FlexPerks points on eligible purchases at gas stations.

Interest Rates and Fees:

Rates:

- APR for Purchase: The intro APR for purchase is 14.49% to 24.49%.

- APR for Balance Transfer: The intro APR for the balance transfer will be 14.49% to 24.49%.

- APR for Cash Advances: The cash advance APR of this card is 24.49%

Fees:

- Annual Fee: For the annual fees, you will be charged $85.

- Balance Transfer Fee: For the balance transfer, you will be charged $5 or a minimum of 3% of the transferred amount.

- Late Payment Fee: If you cannot pay your credit card bill by the due date, you will be charged the late payment fee up to $40.

How to Make Payment for US Bank Credit Card Bill :

In order to make the payment for your US Bank credit card bill, you have to follow these simple instructions below:

- You need to click on this link www.usbank.com.

- Then, from the top right-hand corner of the page, you need to click on the login button.

- Make sure that the Online Banking option is selected, provide your username and password.

- After entering all the necessary details, you just need to click on the login button.

- Once you logged in to your account, you can easily make the payment for your US Bank credit card.

US Bank Customer Support :

For any queries about the US Bank credit card, you can contact the customer service department. To contact the US Bank customer service department, you can use these details:

Call at: 1 (800) 872-2657

Technical Support: 1 (877) 202-0043

Reference Link :